9 Pros and Cons of Selling and Holding Your Small Business

- Date: 07 May, 2021

You’ve poured blood, sweat, and tears into your business. You’ve grown it from nothing by building your website authority, getting the word out, optimizing your SEO, running ad campaigns, and more. Perhaps you even created jobs, hiring people to help you out with your business’s operations.

Now, after the late nights and early mornings working on your business, you’re taking home healthy profits doing something you enjoy.

But at some point, you’ll want out. Whether you’re eyeing retirement or you’ve set your sights on a bigger prize, you won’t be running this business forever.

So should you sell your business to someone else? Or continue to hold onto it?

Well, that depends.

Below, we’ll explore the pros and cons of selling or keeping your business.

Holding Your Small Business: The Pros

Maintain the Income Stream You Know Best

The most obvious advantage of holding onto your small business is the ease and predictability of your income at this point.

Sure, things were rocky at first. Some months brought bountiful profits — others, you were barely skating by.

Now that your business is established, though, earning that income is much easier. You’ve set your processes and procedures. You know your market like the back of your hand. You understand how to generate revenue in your specific business best.

Let’s take Newsweek for example. Besides publishing stories and running ads on their website, they also write comparison posts like this review on memory foam mattresses. Brands love to be featured in digital publications, so naturally they would invest getting a mention in the upcoming post.

News sites and small business blogs can leverage this opportunity through affiliate marketing, and earn a small commission each time someone clicks on the links in their review and makes a purchase. And in such cases, you’ll typically find disclaimers.

Selling your business and launching a new one is much more challenging because you have to do the whole thing over again. It’s much more straightforward to invest time and capital into something good you’ve already got going.

Passing it Down

Plenty of entrepreneurs get into business to give their children a better life. They see business as an investment for their children’s future.

Consequently, some business owners eventually sell their business and set aside the proceeds for their kids.

However, passing down the company instead provides your children with an “out-of-the-box” healthy income stream.

They won’t have to put in the long hours necessary to build the business. As long as you teach them how to run the company correctly — which you could do by hiring them into the business — passing it down offers them lifelong benefits.

They can always sell it later, too, if they’d like to cash it out.

Holding Your Small Business: The Cons

Continuous Work

Holding onto your business might offer a reasonably stable income stream, but you continuously have to work on the company.

Scaling can help you earn more in less time, but you’ll still be responsible for running the company — or at least staying in the loop if you hire managers.

Economic Risk

No matter how much business is booming now, the risk of an economic crash may loom on the horizon.

You’ll have a large amount of assets tied up in this business. If the economy slows down, you could see a severe dent in your income.

On the other hand, selling the business would allow you to spread your proceeds among a diverse set of investments. Diversifying your assets and sources of income is often a solid strategy for weathering economic storms.

Selling Your Small Business: The Pros

Provides Total Freedom

If your business has grown large enough, you may be able to sell it for many millions of dollars — enough money to never work again.

Consequently, if early retirement is on your mind, selling a large enough business can provide you with the funds to do so.

That said, you’ll likely need many millions of dollars to retire early. You’ll be much younger than the average retiree (65 for men and 63 for women), so your assets will have to last much longer.

Even if you’re able to ring, say, $10 million out of selling your business, invest your proceeds wisely. You’ll need even more financial stability than usual when you’re exiting the working world early.

Raises Capital For Other Projects

Perhaps your current business offered you a low barrier to entry in terms of building wealth and earning a healthy income, but you never planned on it being the end of your career.

Instead, you have your eye on bigger, better things. This business was simply a step on the path to those dreams.

Selling your current company once it’s large enough can raise the capital to pursue these new opportunities.

Now, there is risk in liquidating what you know best to jump into new opportunities. You’ll need to perform in-depth financial analysis of whatever you’re pursuing to ensure there’s revenue opportunity and that you’re paying a fair price.

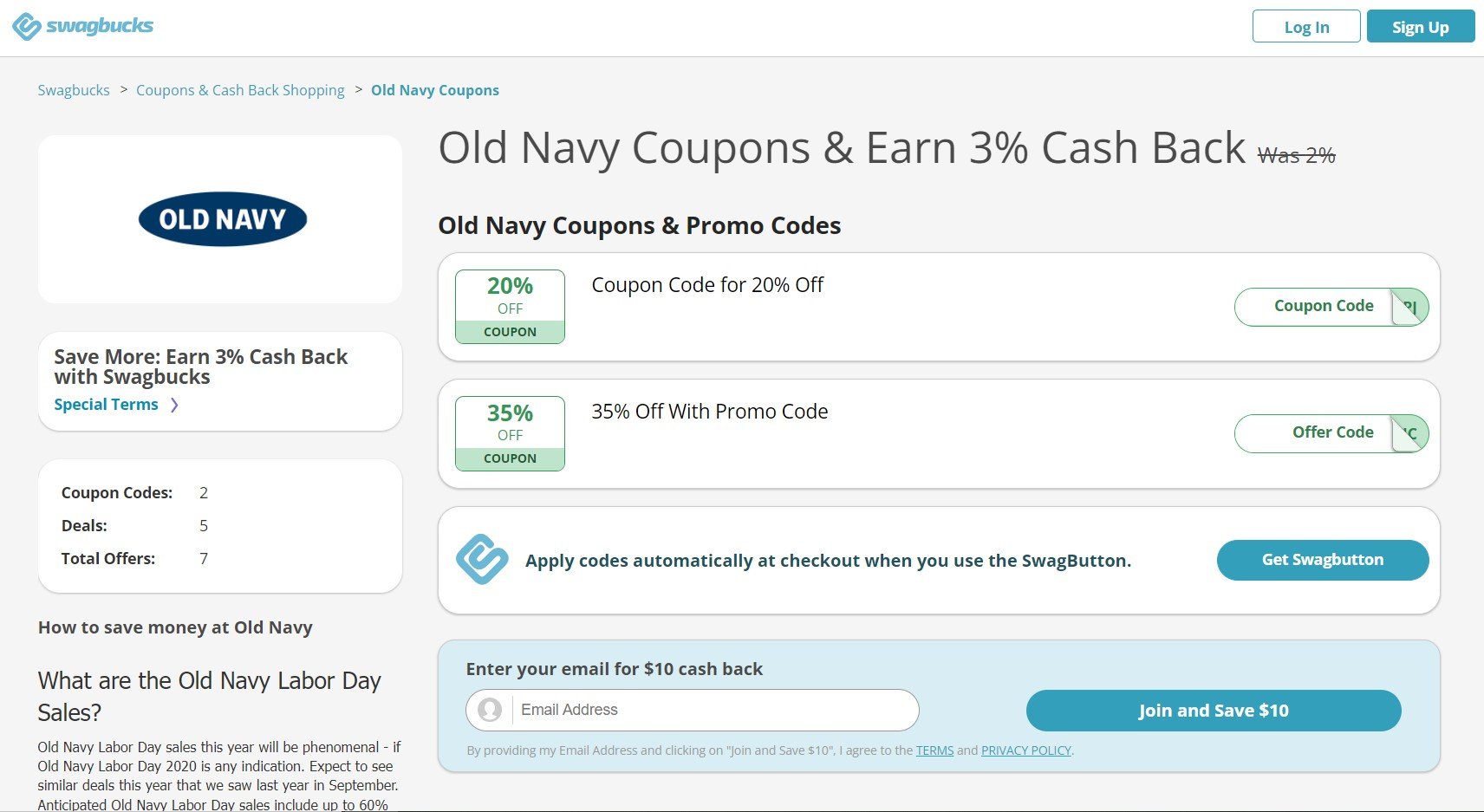

For example, say you wanted to buy this site selling old navy coupons.

As you can see, It earns revenue as an affiliate for Old Navy.

You’d have to look closely at these revenues and various other factors to determine a fair price for this company and its estimated profitability.

Selling Your Small Business: The Cons

Losing an Income Source

Holding onto your small business keeps that easy income source on your side. Once you sell it, you have plenty of cash and free time but no income.

As you know, cash loses value to inflation. You’ll need to find a home (or several) for that cash fast so you can continue to grow your wealth, earn income, and live the life of freedom you wanted.

Now, some entrepreneurs find themselves in a financial squeeze, and they see selling their business as their only choice. After all, it’s quite a valuable asset.

But instead of selling your business to gain extra cash, consider reaching out to investors. Bringing investors on board infuses new capital into your business — capital that can unlock more growth opportunities.

Leaving Growth on the Table

Owning a business is the same thing as owning shares of stock — except for the fact that you hold most or all the shares.

You can sell your business now and lock in all those gains (just like selling stocks at a high price), but you might be leaving more growth on the table while also losing out on the income.

Look carefully over your business’s value chain, and see if you can find any growth potential.

For example, you might discover an untapped market in your business’s niche that could use your product.

Instead of selling your business, start marketing your product towards this new market. If you can secure a whole new customer base, your income will increase, and your business will net you more money if you ever sell later.

Complexity

Selling a business is no simple transaction. Evaluating the company and negotiating with buyers takes a lot of time, and you may have to get professionals such as lawyers involved.

You may not get the best price if you go it alone, either.

If you do sell, consider hiring a business broker to mitigate the complexity. Sure, you’ll pay a bit more in fees, but it’ll be much easier to sell your business for the highest price. Plus, your broker can help perform due diligence and speed up the time it takes to close the deal.

Additionally, move towards using reliable accounting software if you haven’t already. It’ll help you accurately evaluate your company (not to mention track all your financial transactions) through financial statements.

Conclusion

Be sure to think carefully over the decision to sell your business. Consult your attorney, accountant, and financial advisor to help you work out the specifics.

Talk with family and friends, too. They can provide valuable insight on what to do with the business you’ve spent so long nurturing.

Ultimately, the choice is up to you, though — and neither selling nor holding your business is always the superior choice. It depends on your financial circumstances and goals, as well as what kind of lifestyle you want.

- Tagged in: small business tips